|

|

Quantitative ResearchQualitative ResearchTypes of Projects

SurveysTelephoneTelephone surveys can be conducted with either your clients, or your potential clients, and of course with the general public. Marketinfo adheres to a strict set of training procedures for all interviewers and our hands on approach ensures that projects run smoothly. Small projects may only require several interviewers while we also have the capacity for much larger studies through our call centre. We conduct surveys domestically in Australia and New Zealand, and also overseas. So if it's in Europe, Asia or the Americas consider us an option to do it outbound. Face to FaceFace to face studies can be either personal interviews (appointment based) or conducted as "intercept" surveys in a designated location. For executive interviewing we recommend a professional approach that includes appointment letters, detailed interviewing procedures and a client debriefing to let them know how the survey went. Your best chance to connect with your client is to let them know that their input has been used and is having a real effect on the way you do business with them. Online SurveysOnline surveys are conducted using either HTML formatted emails that enable emails to be sent direct to clients, or they can be embedded in your own website, or ours. We can track responses quickly and easily, and email surveys are the most cost effective form of surveying. The limitations of email surveys should be remembered however such as response bias and selection bias, but if it's speed you want, email may fit the bill. Qualitative ResearchDepth InterviewsDepth interviews require an executive level staff member from Marketinfo meeting with your client to collect the required survey information. We treat your clients with the utmost of respect and as with all good communication, we recommend letters of appointment, reminder calls and a courtesy follow up procedure to let the client see their input has been worthwhile. Focus GroupsWe have conducted more than 200 focus groups ranging from such topics as:

Understanding the subject matter is critical to any well run focus group. We spend several days familiarising ourselves with the issues that might come up during groups so we know how to deal with comments as they are made. Probing and delving into comments to make sense of human behaviour and underlying motivations is the goal of most focus group research. Once you get an understanding of beliefs, perceptions, motivations, emotion and behaviour you are in a good position to act on developing or improving your service or product.

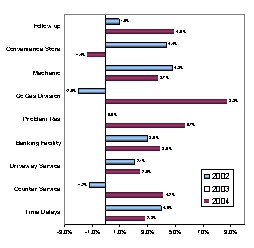

Types of ProjectsSatisfaction ResearchCompanies have come to realise that the best source of revenue is from existing customers. It costs much less (up to 80% less) to maintain your existing customers than it does to pursue new customers. Customer satisfaction research acknowledges this simple fact - keep your existing customers satisfied and they won't leave. The process involves Marketinfo taking a sample of your clients and following them up systematically using standardised survey questionnaires - or if required an in depth face to face assessment of your product with the clients of interest. Start thinking about doing some Satisfaction Research - you will end up reaping the benefits for years to come. Shareholder ResearchMost ASX firms diligently report the standard indices, Earnings per Share, Dividend Yield, Price Earnings ratios and so on. Such varaiables are mandatory in standard reporting. These are important right brain variables, but how many of your shareholders think like accountants? Investors usually think with their emotions and you must factor this into your investor relations strategy. Through a well designed Shareholder Research Program you can get a better understanding of your Shareholders and what is making them tick. Usually we find the whiteboard variables are only half the picture as far as investors are concerned. Company activities such as sustainability efforts, company branding and image and company reputation within its own industry need to be factored into your overall communication effort. Shareholder Research, through a combination of Qualitative and Quantitative assessment, is an invaluable input to your overall strategy. Like any marketplace you need to consider each segment of shareholders separately. They can each respond differently to the same piece of information. Please consider the following separate segments and ask yourself if you are trying to deliver the same message to everyone. Chances are, when you are doing this you are missing the point. Like any audience you need to customise the message.

If you think that Shareholder Research sounds like a good idea, that's because it is! Call us to find out more about setting up a program for your company register. Do you have a new product or service that you are considering launching? The often quoted statistic that up to 85% of new products fail underlines the issue or poor pretesting of concepts. Before determining whether the product will work take a look at market needs, consumer sentiment and estimated demand. Through a combination of qualitative and quantitative research we will evaluate the potential of your new product among the target markets of interest. Don't take the risk - be in the 15% of successful new products - Research can help get you there. Usage and Attitude StudiesTry before you buy. It's the ideal consumer model but few companies try it with their customers. Put your sample product into a real setting, with real users or consumers and we will assess how it performed. Does it need more ooomph, or bounce? Should you try more variety in the way the product is delivered, or should you stand out more distinctly from the competition? Usage and Attitude studies allow you to assess the critical aspects that will lead to product success. Mystery ShoppersWe see the same elements of our company every day, the way phones are answered, the carpet in reception, the width of the aisles, the way we deal with queries - and the result is that we can become blinded by monotony. What will a fresh set of eyes notice about your service delivery and standard? With Mystery Shoppers, nobody at your company knows who the Mystery Shopper is - we send them in with a mission - to find out what your customers experience. Can you afford not to know what things are like from the customer perspective? Call us to find out how you can set up a Mystery Shopper program at your business. Hop to it, or we'll send in a Mystery Shopper ourselves! Image AssessmentYour brand is the most important piece of intellectual property you possess. Your brand has an image, and our job is to find out where your image stands in the consumer's mind - and where your competitors stand. Image evaluation involves plotting a series of dimensions simultaneously to help define the space your brand occupies. How close are you from the "ideal" image and where are the gaps that exist that might be worthwhile pursuing? The bottom line is that you need to guarantee the success of your brand in the future by managing its evolution and its repositioning. Take a moment to think about whether you could refine any elements of your image and your brand (and then call us!) Traffic flowHow many people, cars, or other target objects travel through your area of interest? What is the pattern of visitation? How long do people stay in your venue or what do they do when they arrive? Traffic Flow assessments help determine what the barriers are to people accessing and correctly utilising your services. If it is a geographic area outside - what are the number of movements going past and is there any potential for an outlet store in the area? Would advertising get noticed if you placed it in a particular location? Answer these questions and more with Traffic Flow Assessment. Product ModificationIf it ain't busted don't try to fix it. But what about a product that has potential that is underperforming? The idea behind product modification is to increase the fit between the product and the marketplace. There may be a need to rethink the product's fundamental qualities, or perhaps it is just a matter of tweaking a few minor issues that are preventing the product from greater success. Through a combination of consumer testing and retesting we can help guide the redevelopment or your products so that they can meet their potential. |

|

|

|

|